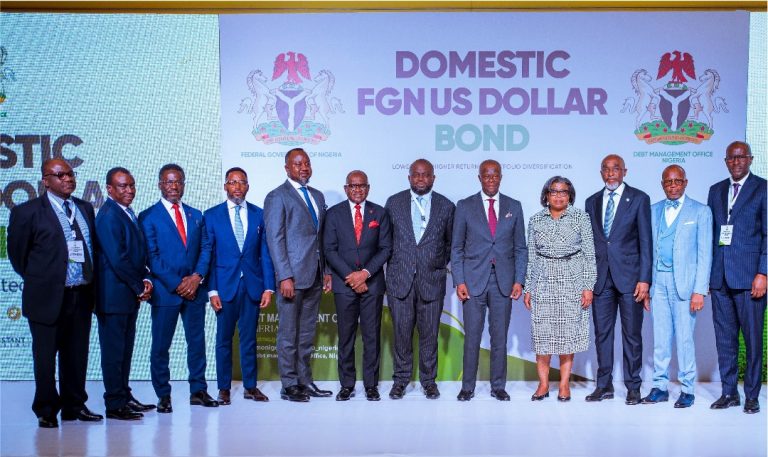

United Capital Group, the top financial services company in Nigeria, led the issue of the Federal Government’s Domestic US Dollar Bond, showcasing its proficiency in the capital markets.

Nigeria’s first-ever domestic bond denominated in US dollars, the bond raised nearly $900 million with a 180 percent subscription rate, making it a historic occasion.

The bond’s enormous demand is a testament to investor faith in both United Capital’s capacity to provide creative financial solutions in difficult markets and the nation’s economic stability and growth potential.

The Group stated in a statement provided to PUNCH Online on Monday that the proceeds of the issuance will be used to fund significant infrastructure development projects, which would have a revolutionary effect on Nigeria’s economy.

“The bond’s success underscores the growing appetite for domestic investment opportunities and the faith in Nigeria’s future as a hub for economic growth. By spearheading this landmark transaction, United Capital continues to solidify its position as a leader in Africa’s financial markets, contributing to the nation’s progress through strategic capital mobilization”, the Group said.

The success of the issuance was noted by Dr. Gbadebo Adenrele, Managing Director, Investment Banking at United Capital Group, who stated, “This is a landmark moment for Nigeria’s capital market, United Capital, as a leader in this category of deals, has set the stage for larger capital offerings by the Nigerian government, other African sovereigns, and large corporations. Investor confidence in the nation’s economic trajectory and our creative financing strategy is demonstrated by the performance of the Domestic FGN US Dollar bond.”

In a similar vein, Peter Ashade, Group CEO of United Capital Group, underscored the company’s contribution to the development of Africa’s capital markets.

He said, “The successful issuance of Nigeria’s inaugural Domestic FGN US Dollar bond is a major milestone for both the country and United Capital. This transaction aligns perfectly with our vision of transforming the African financial landscape. By providing access to innovative investment opportunities, we are empowering investors and contributing to Nigeria’s economic growth.”

Africa Finance Corporation served as the Global Coordinator in addition to United Capital’s roles as Lead Issuing House and Coordinator for the issuing of domestic bonds.

The Issuing Houses for the transaction were Vetiva Advisory Services Limited, Stanbic IBTC Capital Limited, and Meristem Capital Limited. Olaniwun Ajayi LP and G. Elias were the lawyers, and Constant Capital Markets & Securities Limited and Iron Global Markets Limited were the financial advisers. Serving as a Trustee was Greenwich Trustees Limited.

United Capital Group’s leadership and management of major capital market activities is further reinforced by its crucial involvement in this historic transaction. Its standing as a pioneer in Africa’s financial scene is further cemented by recent accomplishments like the listing of Transcorp Power Plc on the Nigerian Exchange Limited and the issue of Sierra Leone’s first local currency corporate bond.