In a recent report released by Tesla on Wednesday they disclosed that the third-quarter earnings have came in just shy of expectations.

Tesla reported third-quarter earnings Wednesday that topped analysts’ estimates even as revenue came in just shy of expectations.

In the report published by the company, it was noted that the Earnings per share stands at 72 cents, adjusted vs. 58 cents, while Revenue is $25.18 billion vs. $25.37 billion expected. In the expectation as indicated by Wall Street, the figures have gone above what was expected by the company.

It was disclosed that the revenue had increased by 8% in the quarter from $23.35 billion a year earlier. The net income of the company has been reported to have increased to about $2.17 billion, or 62 cents a share; in the earlier figures, it was indicated that the company had $1.85 billion, or 53 cents a share, which was the figure present a year ago.

The data indicate that automotive revenue increased 2% to $20 billion from $19.63 billion in the same period a year earlier and has been about flat since late 2022. The company’s energy generation has increased revenue by 52% to $2.38 billion. Some other revenues, including revenue from non-warranty repairs of Tesla vehicles, have been disclosed to increase by 29% to $2.79 billion.

In the report at the shareholder deck, it was reported that Tesla on October 22 disclosed that it has reached 7 million vehicles produced and that its newest offering which is the Cybertruck, has become the third-best-selling fully electric vehicle in the U.S., the electric power vehicle behind Model 3 and Model Y. Tesla.

Tesla’s angular steel pickup has been reported to have issues that have plunged it after production. Some of the complaints include quality issues. The company disclosed that, according to estimates provided by Kelley Blue Book, it saw 16,000 cyber trucks in the U.S. in the third quarter. Tesla explained that Cybertruck “achieved a positive gross margin for the first time.

Responding to the earnings, CEO Elon Musk stated that his “best guess” is that vehicle growth will reach 20% to 30% next year due to lower-cost vehicles” and the advent of autonomy.

According to the reports, deliveries increased 6% from last year. However, they fell short of analysts’ expectations and followed two straight quarters of year-over-year declines. It was learnt that Tesla has been offering various discounts and incentives to spur sales.

The company noted that despite ongoing macroeconomic conditions, it expects to achieve slight growth in vehicle deliveries in 2024. In its earnings deck Wednesday, the company said it aims to launch more affordable models in the first half of 2025.

Tesla is facing increased competitive pressure, especially in China, from companies such as BYD and Geely and a new generation of automakers, including Li Auto and Nio. In the U.S., legacy automakers Ford and General Motors are starting to sell more electric vehicles despite reversing prior electrification commitments.

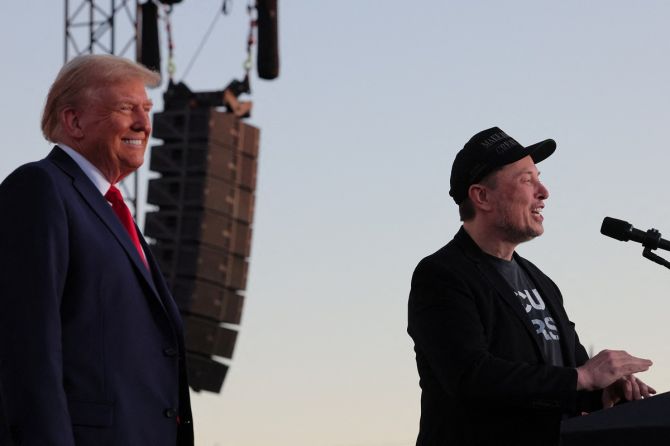

The earnings report comes less than two weeks after a much-anticipated robotaxi event that left shareholders wanting more details and lands about two weeks before the presidential election, which has occupied a hefty part of Musk’s schedule of late as he campaigns for former President Donald Trump.

In some of the questions that investors have asked via online platforms, according to Technologies, many shareholders have shown interest in knowing how Musk’s pro-Trump activism impacts Tesla and its stock price.

Before Wednesday’s after-hours pop, the stock was down 18% in October and headed for its worst month since January. The shares were down 14% for the year, while the Nasdaq is up 22% over that stretch.

It was reported that Musk has spent tens of millions of dollars to get Trump back into the White House, even though the former president doesn’t support federal spending on EVs, charging infrastructure and environmental regulations that have benefited Tesla for years.

Musk also said at a recent event in Harrisburg, Pennsylvania, that he views many U.S. government agencies and ordinances as ineffective and unwarranted.