The Nigerian Debt Management Office (DMO) has declared that the Nigerian total stock debt has risen to its worst as it trends.

It rose by N191bn in the first quarter of this year but this time, the (DMO) announced on Wednesday that the debt stock rose to N33.107tn as of the end of March 2021 from N32.916tn in December 2020.

But the country eternal debt however reduced due to the redemption by Nigeria of the $500m Eurobond in January.

You may also like: Bishop Seun warns Buhari to reverse Twitter ban in 7 days so to avoid his wrath.

The office also confirmed this by saying:

“The debt stock also includes promissory notes in the sum of N940.22bn issued to settle the inherited arrears of the FGN to state governments, oil marketing companies, exporters and local contractors.”

“Compared to the total public debt stock of N32.92tn as at December 31, 2020, the increase in the debt stock was marginal at 0.58 per cent”

“External debt stock declined from $33.348bn as of December 31, 2020, to $32.86bn due to the redemption by Nigeria of the $500m Eurobond in January 2021.”

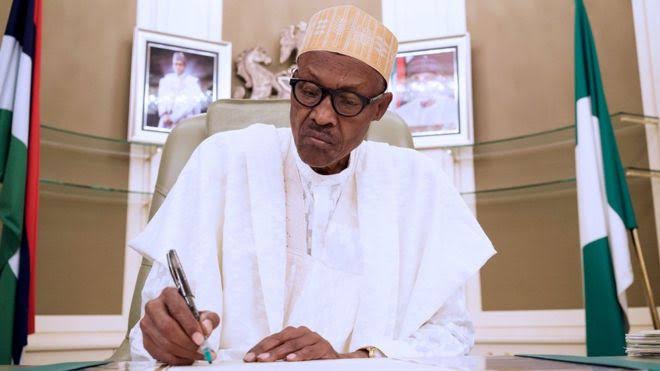

The president of Nigeria is yet to utter his concern over this as Nigerians react massively via top social media platforms.